Lenin Lopez, Esq.

Priya Cherian Huskins, Esq.

Oct 05, 2022Directors and officers need to have strong protections in place to reduce their exposure to personal liability—and to respond in case of investigations or litigation.

As a director or officer of a public or private company, you need to have strong protections in place to reduce your exposure to personal liability, as well as appropriately respond in case you become subject to an investigation or are named in litigation. The alternative is to leave yourself open to expensive problems.

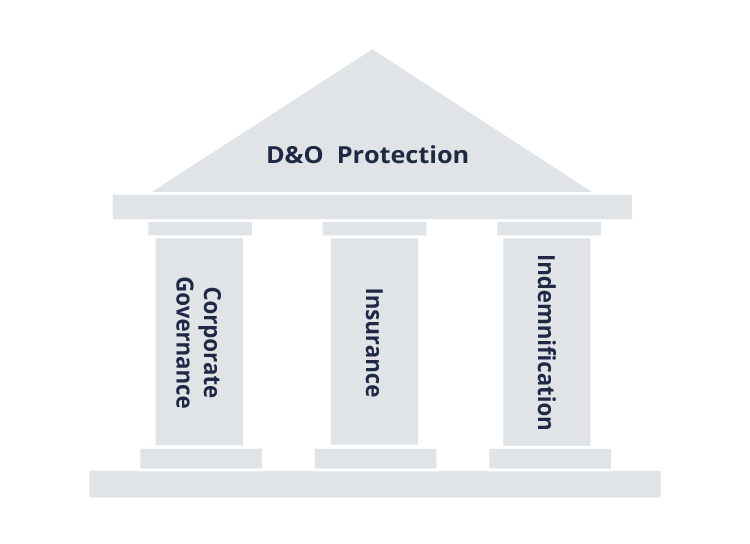

This graphic provides a good way to think about these protections:

When each of the three pillars is well structured, you should have optimal protection from personal losses if you are sued for alleged or actual acts in your capacity as a director or officer.

The multi-million-dollar question: “What does it mean to be well structured?”

This article walks through some of the considerations directors and officers should make when assessing the protections afforded to them by the companies they serve. If you're considering taking on a new director or officer role, what follows will be especially valuable to you as you conduct your due diligence.

A company’s organizational documents (i.e., certification of incorporation and bylaws) will typically include language indemnifying directors (and often officers) “to the fullest extent permitted by law.” There are generally references to insurance and the ability of the company to enter into indemnification agreements with its directors and officers. However, these documents tend to be light on details and may exclude important points such as:

Waiting to negotiate these details until after a lawsuit is filed could potentially put an enormous amount of financial pressure on directors and officers who need to hire lawyers right away. This is where insurance and indemnification agreements can help bolster and/or clarify the general indemnification parameters included in the organizational documents.

Specific to Delaware companies, see here for a discussion regarding new protection that can be extended to officers, and here for a discussion regarding why it is important to include federal choice of forum provisions in your company’s certificate of incorporation.

Remember too that a strong governance risk profile can dramatically reduce a company’s—and its directors’ and officers’—liability exposure. How so? Maintaining and adhering to good corporate governance practices is essential for any company to effectively and proactively identify and respond to risks. For directors, this is especially important given their duty of corporate oversight, which is part of their fiduciary duty of loyalty to monitor a company’s operations and associated risks. As we previously discussed, oversight claims brought against companies, directors, and officers can yield massive financial settlements for those plaintiffs that bring them.

Elements of a strong governance risk profile for public companies can include:

The number and types of policies that a company maintains will vary depending on its risk profile. However, having policies isn’t enough. Companies need to revisit their policies and update them to reflect changes to their business, regulatory environment, risks, etc. Lastly, training on these policies is important, and in some cases required, to encourage a strong culture of compliance. Latham & Watkins provides some considerations that companies should take when building a best-in-class compliance program.

It’s not just oversight claims that can result in large settlements against companies. We previously covered the five categories of suits in which large dollar settlements may be more likely. Moreover, given the rising costs associated with responding to investigations and engaging defense counsel, even if claims are dismissed, directors and officers could be placed in a precarious financial position if they are expected to front investigation and defense costs.

This is where a robust D&O insurance program is critical. A company and its directors and officers generally are afforded coverage through three separate “Sides”, Side A through C, with a shared limit of liability. We provided an overview of D&O insurance, but to summarize: “Side A” provides coverage for non-indemnifiable losses for directors and officers, such as bankruptcy and derivative suits; “Side B” reimburses the company for indemnifiable losses for directors and officers; and “Side C” reimburses the company for its defense costs and settlements of securities claims. You may also be familiar with what is known as standalone Side A, which is reserved exclusively for individual directors and officers. We also encourage you to view our Whiteboard Breakdowns on Sides A, B & C and on Standalone Side A Difference in Conditions.

A question that you will inevitably have as a director or officer will be: “Do we have enough insurance coverage?” Working with a broker that understands your business, the market, risk profile, and risk tolerance will go a long way in helping tailor a D&O insurance program that is set at a level that can appropriately respond to claims.

Finally, independent directors may want to consider purchasing a wealth security policy, a type of insurance policy only available to independent directors. This type of policy is purchased by an individual director, usually schedules all the directors’ boards, and provides a limit that doesn’t have to be shared with anyone else.

A company’s organizational documents typically cover indemnification, albeit superficially, but a thoughtfully drafted indemnification agreement between you and the company can provide you with significant benefits. These benefits include:

As we previously covered what D&Os should consider when negotiating and maintaining their personal indemnification agreements, we won’t dive into that in detail here. However, we want to emphasize that it is a good idea to revisit your indemnification agreement every few years. A primary reason is to account for changes in the company’s risk profile, as well as developments in case law or lessons learned from other companies.

One example of why periodically revisiting your indemnification agreement is a good idea is a settlement reached by five former outside directors of Just for Feet. In this case, the company filed for bankruptcy after which it, along with its directors and officers, was sued. The executives drained all the D&O policies, leaving the independent directors to pay out of their own pockets. The settlement amounted to $41.5 million.

An independent director liability insurance policy would have saved the day for these outside directors. That type of policy would have provided a reserve of segregated funds just for the outside directors—funds that could not be touched by the corporation or its officers. However, that type of insurance may not make financial sense for every company. An alternative solution is to include verbiage in the indemnification agreements that prohibits the company from using insurance to settle claims to the detriment of their outside directors.

The Just for Feet example happened in 2007 and yet one can still find many indemnification agreements filed by companies with the Securities and Exchange Commission that do not include either of the solutions noted above. This is where consulting with a trusted legal advisor who has expertise in reviewing and drafting these documents will be worthwhile. They will be able to evaluate your indemnification agreement and suggest proposed enhancements based on developments in the law or examples like Just for Feet.

As a director or officer, you shouldn’t have to lose sleep over personal liability. Having a well-structured corporate governance program, a tailored director and officer insurance program, and a state-of-the-art indemnification agreement can go a long way to helping you sleep at night.

Woodruff Whiteboard Breakdowns: Independent Directors Liability vs. Wealth Security Policies